By Order of the Board of Directors, | |

Jay Madhu | |

Chief Executive Officer | |

May 2, 2022 | |

Grand Cayman, Cayman Islands |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ | |

Filed by a Party other than the Registrant |

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

OXBRIDGE RE HOLDINGS LIMITED |

(Name of Registrant As Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table |

OXBRIDGE RE HOLDINGS LIMITED

Suite 201

42 Edward Street

P.O. Box 469

Grand Cayman, KY1-9006

Cayman Islands

NOTICE OF VIRTUAL ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 14, 2020

Notice is hereby given that the Annual General Meeting of Shareholders (the “Meeting”) of Oxbridge Re Holdings Limited (the “Company”, “we” or “us”) will be held in a virtual meeting format only. You will not be able to attendat the Annual Meeting physically. The Meeting will be held via a live webcastCompany’s office, Suite 201, 42 Edward Street, George Town, Cayman Islands on Thursday, May 14, 2020,Wednesday, June 1, 2022, at 9:3:00 a.m. (Central Time). Shareholders may attend, vote and submit questions during the Meeting via the Internet by firstly logging in at www.iproxydirect.com/oxbr with your Control ID and Request ID, and thereafter follow the instructions to join the virtual meeting.You may also attend the Meeting by proxy, and may submit questions ahead of the Meeting through the designated website. We expect to resume in person shareholder meetings in successive years. The Meeting will havep.m. (local time), for the following purposes:

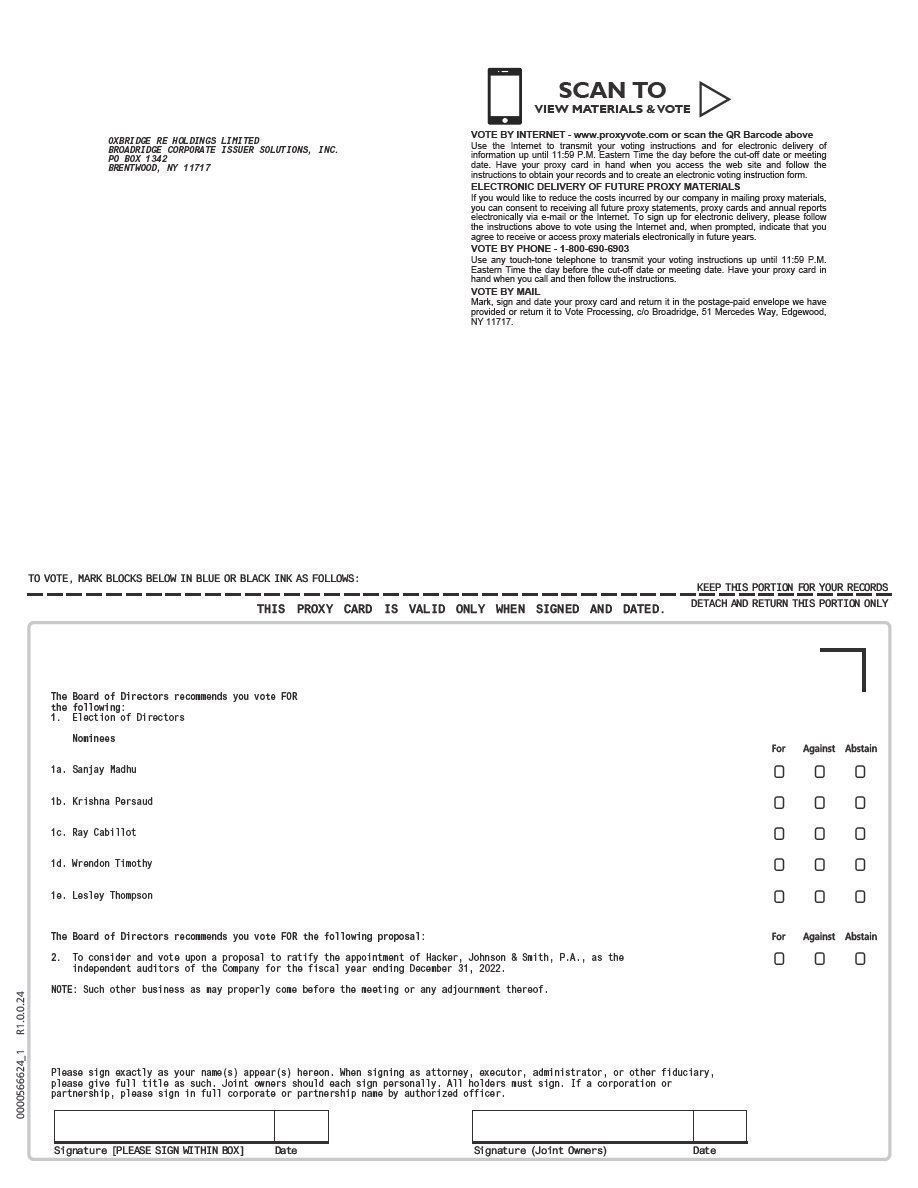

1. | To consider and vote upon a proposal to elect five directors to serve on the Board of Directors of the Company until the Annual General Meeting of Shareholders of the Company in 2023; and |

2. | To consider and vote upon a proposal to ratify the appointment of Hacker, Johnson & Smith, P.A., as the independent auditors of the Company for the fiscal year ending December 31, 2022. |

3. | To transact such other business that may properly come before the meeting or any adjournments or postponements thereof. |

Information concerning the matters to be acted upon at the Meeting is set forth in the accompanying Proxy Statement.

Only shareholders of record, as shown by the transfer books of the Company, at the close of business on April 9, 2020,22, 2022, will be entitled to notice of, and to vote at, the Meeting or any adjournments or postponements thereof. To be admitted to the annual meeting, stockholders must enter the Control ID and Request ID numbers found on their proxy card. Whether or not you plan to attend the Meeting, we hope you will vote as soon as possible. Voting your proxy will ensure your representation at the Meeting. We urge you to carefully review the proxy materials and to vote FOR the election of each director nominee named in Proposal One and FOR Proposal Two.

By Order of the Board of Directors, | |

Jay Madhu | |

Chief Executive Officer | |

May 2, 2022 | |

Grand Cayman, Cayman Islands |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SHAREHOLDER MEETING TO BE HELD ON MAY 14, 2020:

To access our Proxy Statement and our Annual Report to Shareholders,

please visit www.iproxydirect.com/oxbr orwww.oxbridgere.com/2020AGM

TABLE OF CONTENTS

3 | |

12 | |

11 | |

11 | |

12 | |

16 | |

17 | |

18 | |

20 | |

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS | 20 |

21 | |

21 |

OXBRIDGE RE HOLDINGS LIMITED

Suite 201

42 Edward Street

P.O. Box 469

Grand Cayman, KY1-9006

Cayman Islands

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 14, 2020

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Oxbridge Re Holdings Limited (the “Company”) of proxies for use at the Annual General Meeting of Shareholders of the Company (the “Meeting” or “Annual Meeting”) to be held via a live webcastat the Company’s office, Suite 201, 42 Edward Street, George Town, Cayman Islands on Thursday, May 14, 2020Wednesday, June 1, 2022 at 9:3:00 a.m. (Central Time)p.m. (local time), and at any and all adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of Annual General Meeting of Shareholders. Shareholders may attend, vote and submit questions during the Meeting via the Internet by firstly logging in at www.iproxydirect.com/oxbr with your Control ID and Request ID, and thereafter follow the instructions to join the virtual meeting.You may also attend the Meeting by proxy and may submit questions ahead of the Meeting through the designated website.The Company’s Annual Report to Shareholders is included with this Proxy Statement for informational purposes and not as a means of soliciting your proxy.

This Proxy Statement and the accompanying proxy card and Notice of Annual General Meeting of Shareholders are expected to be provided to shareholders on or about April 28, 2020.

Matters to be Voted Upon at the Meeting

You are being asked to consider and vote upon the following proposals:

1. | To elect five directors to serve on the Board of Directors of the Company (our “Board”) until the Annual General Meeting of Shareholders of the Company in 2023 (“Proposal One”); and |

2. | To ratify the appointment of Hacker, Johnson & Smith, P.A., as the independent auditors of the Company for the fiscal year ending December 31, 2022 (“Proposal Two”). |

Voting Procedures

As a shareholder of the Company, you have a right to vote on certain matters affecting the Company. The proposals that will be presented at the Meeting and upon which you are being asked to vote are discussed above. Each ordinary share of the Company you owned as of the record date, April 9, 2020,22, 2022, entitles you to one vote on each proposal presented at the Meeting, subject to certain provisions of our Third Amended and Restated Memorandum and Articles of Association (our “Articles”), as described below under “Voting Securities and Vote Required.”

Methods of Voting

You may vote by mail, by telephone, over the Internet or virtuallyin person at the Meeting.

Voting by Mail

. You may vote by signing the proxy card and returning it in the prepaid and addressed envelope enclosed with the proxy materials. If you vote by mail, we encourage you to sign and return the proxy card even if you plan to attend the Meeting so that your shares will be voted if you are unable to attend the Meeting.Voting by Telephone

. To vote by telephone, please follow the instructions included on your proxy| 1 |

Voting over the Internet

. To vote over the Internet, please follow the instructions included on your proxyVoting virtuallyin Person at the Meeting

As of April 9, 2020,22, 2022, the record date for the determination of persons entitled to receive notice of, and to vote at, the Meeting (the “Record Date”), 5,733,5875,781,587 ordinary shares were issued and outstanding. The ordinary shares are our only class of equity securities outstanding and entitled to vote at the Meeting.

Subject to the provisions of the Articles, each ordinary share is entitled to one vote per share. However, under the Articles, the Board shall reduce the voting power of any holder that holds 9.9% or more of the total issued and outstanding ordinary shares (such person, a “9.9% Shareholder”) to the extent necessary such that the holder ceases to be a 9.9% Shareholder. In connection with this reduction, the voting power of the other shareholders of the Company may be adjusted pursuant to the terms of the Articles. Accordingly, certain holders of ordinary shares may be entitled to more than one vote per share subject to the 9.9% restriction in the event that our Board is required to make an adjustment on the voting power of any 9.9% Shareholder.

Voting Reduction

The applicability of the voting power reduction provisions to any particular shareholder depends on facts and circumstances that may be known only to the shareholder or related persons. Accordingly, we request that any holder of ordinary shares with reason to believe that it is a 9.9% Shareholder, contact us promptly so that we may determine whether the voting power of such holder’s ordinary shares should be reduced. By submitting a proxy, a holder of ordinary shares will be deemed to have confirmed that, to its knowledge, it is not, and is not acting on behalf of, a 9.9% Shareholder. The directors of the Company are empowered to require any shareholder to provide information as to that shareholder’s beneficial ownership of ordinary shares, the names of persons having beneficial ownership of the shareholder’s ordinary shares, relationships with other shareholders or any other facts the directors may consider relevant to the determination of the number of ordinary shares attributable to any person. The directors may disregard the votes attached to ordinary shares of any holder who fails to respond to such a request or who, in their judgment, submits incomplete or inaccurate information. The directors retain certain discretion to make such final adjustments that they consider fair and reasonable in all the circumstances as to the aggregate number of votes attaching to the ordinary shares of any shareholder to ensure that no person shall be a 9.9% Shareholder at any time.

Quorum; Vote Required

The attendance of two or more persons representing, virtuallyin person or by proxy, more than 50% in par value of the issued and outstanding ordinary shares as of the Record Date, is necessary to constitute a quorum at the Meeting.

Assuming that a quorum is present, the affirmative vote of the holders of a simple majority of the issued and outstanding ordinary shares voted at the Meeting is required for election of each of the director nominees in Proposal One and for the approval of Proposal Two.

With regard to any proposal or director nominee, votes may be cast in favor of or against such proposal or director nominee or a shareholder may abstain from voting on such proposal or director nominee. Abstentions will be excluded entirely from the vote and will have no effect except that abstentions and “broker non-votes” will be counted toward determining the presence of a quorum for the transaction of business.

| 2 |

Generally, broker non-votes occur when ordinary shares held by a broker for a beneficial owner are not voted on a particular proposal because the broker has not received voting instructions from the beneficial owner, and the broker does not have discretionary authority to vote on a particular proposal.

Recommendation

Our Board recommends that the shareholders take the following actions at the Meeting:

1. | Proposal One: to vote FOR the election of each of the five director nominees to serve on the Board until the Annual General Meeting of Shareholders of the Company in 2023; and |

2. | Proposal Two: to vote FOR the ratification of the appointment of Hacker, Johnson & Smith, P.A., as the independent auditors of the Company for the fiscal year ending December 31, 2022. |

SOLICITATION AND REVOCATION

Proxies must be received by us by 11:59 p.m. (local time) on May 13, 2020,31, 2022, the day prior to the Meeting day. A shareholder may revoke his or her proxy at any time up to one hour prior to the commencement of the Meeting.

To do this, you must:

· | enter a new vote by telephone, over the Internet or by signing and returning another proxy card at a later date; | |

· | file a written revocation with the Secretary of the Company at our address set forth above; | |

· | file a duly executed proxy bearing a later date; or | |

· | appear in person at the Meeting and vote in person. |

A shareholder of record may revoke a proxy by any of these methods, regardless of the method used to deliver the shareholder’s previous proxy. If your ordinary shares are held in street name, you must contact your broker, dealer, commercial bank, trust company or other nominee to revoke your proxy.

The individuals designated as proxies in the proxy card are officers of the Company.

All ordinary shares represented by properly executed proxies that are returned, and not revoked, will be voted in accordance with the instructions, if any, given thereon. If no instructions are provided in an executed proxy, it will be voted FOR the election of each director nominee named in Proposal One and FOR Proposal Two, and in accordance with the proxy holder’s best judgment as to any other business that may properly come before the Meeting. If a shareholder appoints a person other than the persons named in the enclosed form of proxy to represent him or her, such person should vote the shares in respect of which he or she is appointed proxy holder in accordance with the directions of the shareholder appointing him or her.

PROPOSAL ONE

ELECTION OF DIRECTORS OF THE COMPANY

Our Articles currently provide that our Board shall consist of not less than four (4) directors (exclusive of alternate directors). We currently have fourfive directors serving on our Board, and our Board has nominated those fourfive directors – Jay Madhu, Krishna Persaud, Ray Cabillot, Wrendon Timothy and Mayur PatelLesley Thompson – for re-election as directors to serve until the Annual General Meeting of Shareholders of the Company in 2021.

Our Board has no reason to believe that any of these director nominees will not continue to be a candidate or will not be able to serve as a director of the Company if elected. In the event that any nominee is unable to serve as a director, the proxy holders named in the accompanying proxy have advised that they will vote for the election of such substitute or additional nominee(s) as our Board may propose. Our Board unanimously recommends that you vote FOR the election of each of the nominees.

| 3 |

Director Nominees

Each of the director nominees is currently serving as a director of the Company and is standing for re-election. Unless otherwise directed, the persons named in the proxy intend to vote all proxies FOR the election of each of the following director nominees:

| Name | Age | Position | Director Since |

Jay Madhu(3)(5) | 53 | Chairman of the Board of Directors, Chief Executive Officer, and President | 2013 |

Krishna Persaud(1)(2)(4)(5) | 58 | Director | 2013 |

Ray Cabillot(1)(2)(3)(4)(5) | 57 | Director | 2013 |

Mayur Patel, M.D.(1)(2)(3)(4) | 64 | Director | 2013 |

Name |

| Age |

| Position |

| Director Since |

|

|

| ||||

Jay Madhu(3)(5) |

| 55 |

| Chairman of the Board of Directors, Chief Executive Officer, and President |

| 2013 |

|

|

| ||||

Krishna Persaud(1)(2)(4)(5) |

| 60 |

| Director |

| 2013 |

|

|

| ||||

Ray Cabillot(1)(2))(4)(5) |

| 59 |

| Director |

| 2013 |

|

|

| ||||

Wrendon Timothy(3)(5) |

| 41 |

| Director |

| 2021 |

|

|

|

|

|

|

|

Lesley Thompson(1)(2)(3)(4) |

| 50 |

| Director |

| 2021 |

(1)

Member of Audit Committee.(2)

Member of Compensation Committee.(3)

Member of Underwriting Committee.(4)

Member of Nominating and Corporate Governance Committee.(5)

Member of Investment Committee.The nominees have consented to serve as directors of the Company if elected.

Set forth below is biographical information concerning each nominee for election as a director of the Company, including a discussion of such nominee’s particular experience, qualifications, attributes or skills that led our Nominating and Corporate Governance Committee and our Board to conclude that the nominee should serve as a director of our Company.

Jay Madhu.

Mr. MadhuMr. Madhu is an approved director with Cayman Islands Monetary Authority, Bermuda Monetary Authority, Florida Office of Insurance Regulation, Arkansas Insurance Department, California Department of Insurance, Maryland Insurance Administration, New Jersey Department of Banking and Finance, North Carolina Department of Insurance, Ohio Department of Insurance, Pennsylvania Insurance Department and South Carolina Department of Insurance. Mr. Madhu attended Northwest Missouri State University where he studied marketing and management. Mr. Madhu brings considerable business and capital markets experience to our Board of Directors.

| 4 |

Mr. Madhu brings considerable business, capital markets and marketing experience to our Board.

Krishna Persaud.

Mr. Persaud has been a director of our Company since April 2013. He has also been, since April 2013, a director of our reinsurance subsidiary, Oxbridge Reinsurance Limited. Mr. Persaud is a founder and the President, since June 2002, of KPC Properties, LLC, a real estate investment firm, where he leverages his knowledge and experience to identify opportunities to add value to real properties in the state of Florida. He implements a strategy of acquiring, adding value and relinquishing or holding the improved asset. He has demonstrated consistent success in implementing his strategy in real estate investments. Since June 2002, Mr. Persaud has been an asset manager, demonstrating the ability to consistently exceed average market returns. From May 2007 to May 2011, Mr. Persaud was a director of HCI Group, Inc., a publicly traded holding company owning subsidiaries primarily engaged in the property and casualty insurance business. Mr. Persaud received an award from the Tampa Bay INDOUS Chamber of Commerce as one of the most successful businessmen of the year in Tampa. Previously, he spent ten years working with several consulting firms and municipalities providing design and construction management services for a wide variety of building systems and public works projects. Mr. Persaud earned his Bachelor of Science degree in Mechanical Engineering and a Master’s Degree in Civil Engineering from City College of City University of New York. He holds licenses as a Professional Engineer in the States of Florida, New York and California.Mr. Persaud brings considerable investment experience to our Board.

Ray Cabillot.

Mr. Cabillot has been a director of our Company since April 2013. He has also been, since April 2013, a director of our reinsurance subsidiary, Oxbridge Reinsurance Limited. Since 1998, Mr. Cabillot has served as Chief Executive Officer and director of Farnam Street Capital, Inc., the General Partner of Farnam Street Partners L.P., a private investment partnership. Prior to his service at Farnam Street Capital, Mr. Cabillot was a Senior Research Analyst at Piper Jaffrey, Inc., an investment bank and asset management firm, from 1989 to 1997. Early in his career, Mr. Cabillot worked for Prudential Capital Corporation as an Associate Investment Manager and as an Investment Manager. Mr. Cabillot is currently a director for Pro-Dex, Inc.Mr. Cabillot brings considerable investment expertise to our Board.

Wrendon Timothy. Mr. Timothy has been a director of our Company since OctoberNovember 2021. Mr. Timothy has served as the Chief Financial Officer and Corporate Secretary of our Company since August 2013. Since 1997,In his role, he has beenprovided financial and accounting consulting services with a founding partnerfocus on technical and SEC reporting, compliance, internal auditing, corporate governance, mergers & acquisitions analysis, risk management, and CFO and controller services. Mr. Timothy also serves as an executive and director of Oxbridge Reinsurance Limited and Oxbridge Re NS, the wholly-owned licensed reinsurance subsidiaries of Oxbridge Re. Mr. Timothy serves as the Chief Financial Officer, Treasurer, Secretary and director of Oxbridge Acquisition Corp. (NASDAQ: OXAC) and its sponsor, OAC Sponsor Ltd.

Mr. Timothy started his financial career at PricewaterhouseCoopers (Trinidad) in 2004 as an Associate in their assurance division, performing external and internal audit work, and tax-related services. Throughout his career progression and transitions through KPMG Trinidad and PricewaterhouseCoopers (Cayman Islands), Mr. Timothy has successfully delivered services across both the public and private sectors. Mr. Timothy management roles allowed him to be heavily involved in the planning, budgeting, and leadership of engagement teams, serving as a liaison for senior client management, and advising on technical accounting matters. Mr. Timothy is a Fellow of the Association of Chartered Certified Accountants (ACCA), a Chartered Corporate Secretary and also holds a Postgraduate Diploma in Business Administration and a practicing physicianMaster of Business Administration, with American Radiology Services (“ARS”) basedDistinction (with a Specialism in Baltimore, Maryland. In addition to practicing Radiology at three hospitalsFinance (with Distinction)), from Heriot Watt University in Edinburg, Scotland. Mr. Timothy holds directorship and several free-standing imaging centers, Dr. Patel playsleadership roles with a number of privately-held companies, and also serves on various not-for-profit organizations, including his governance role as Chairman of Audit & Risk Committee of The Utility Regulation & Competition Office of the Cayman Islands. Mr. Timothy is an active role in the administrative and financial functionsFellow Member of the group. He isACCA, an electedactive member of the boardCayman Islands Institute of directorsProfessional Accountants (CIIPA), and an active Associate Member of American Radiology Associatesthe Chartered Governance Institute (formerly the Institute of Chartered Secretaries and in additionAdministrators).

| 5 |

Mr. Timothy brings considerable finance, governance and risk management experience to our Board.

Lesley Thompson. Ms. Thompson has served as the Managing Director of Willis Towers Watson Management (Cayman) Ltd. (“WTW Cayman”) since March 2020 and as Secretary since April 2020. WTW Cayman is part of the Willis Towers Watson group (NASDAQ: WTW). Ms. Thompson is responsible for the strategy and leadership of WTW Cayman providing insurance management and brokerage services to its clients. Ms. Thompson also provides independent director services to insurance and structured finance companies . Ms. Thompson currently serves as a director to ICP Investment Holdings Limited since November 2016, ICP Reinsurance Limited since January 2017 and Evergreen Pacific Reinsurance Company Limited since August 2019. Ms. Thompson previously served as Vice President of Maples Fiduciary Services (Cayman) Limited from February 2016 to March 2020 where she headed the chairmaninsurance management services and provided independent director services to insurance and structured finance companies. From January 2000 to January 2016, Ms. Thompson held senior roles of the finance committee. He is alsoAssistant Vice President, Assistant Manager & Group Vice President at Aon Insurance Managers (Bermuda) Ltd., HSBC Financial Services (Cayman) Ltd., Atlas Insurance Management (Cayman) Ltd. and Advantage International Management (Cayman) Ltd. where she led and managed large portfolios of property & casualty and life & annuity companies, including special purpose vehicles, segregated portfolio companies and group captives. Ms. Thompson has served as a member of the Retirement, Quality Assuranceexecutive committee of The Insurance Managers Association of Cayman since August 2020 and Operations committees. He has published many peer reviewed articles and also co-authored a book chapter inis the field of Radiology. He has also lectured extensively both as an invited guest speaker and also at national meetings in the field of Radiology and Molecular Imaging. He has held academic appointments as an Assistant Professor of Radiology at University of Vermont, School of Medicine (1989-1992) and at University of Maryland, School of Medicine (1989-2000). As a principal of ARS, he participated in the group’s corporate affiliation in the capital markets with Advent International (a global private equity group) and with CML Healthcare (a Canadian based medical diagnostics service provider). Dr. Patelcurrent Chairperson. Ms. Thompson is a double board-certified physicianChartered Management Accountant (ACMA & CGMA), a Fellow of Captive Insurance (FCI) and a diplomatholds the Accredited Director (Acc. Dir.) designation through the Chartered Governance Institute of the American Board of Radiology and American Board of Nuclear Medicine. Outside of medicine, Dr. Patel has 20 years ofCanada.

Ms. Thompson brings invaluable experience in investing in the public markets as well as in private equity offerings. Dr. Patel is the brother-in-law of Paresh Patel, our former Chairman of the Board who resigned from our Board effective December 31, 2017.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS

VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED ABOVE.

PROPOSAL TWO

RATIFICATION OF THE COMPANY’S AUDITORS

Upon recommendation of the Audit Committee of the Company, our Board proposes that the shareholders ratify the appointment of Hacker, Johnson & Smith, P.A. (“Hacker Johnson”) to serve as the independent auditors of the Company for the fiscal year ending December 31, 2020.2022. Hacker Johnson served as the independent auditors of the Company for the fiscal years ended December 31, 2013 through December 31, 2019.

Although ratification is not required by law, our Board believes that shareholders should be given the opportunity to express their views on the subject. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. Even if this appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interest of the Company and its shareholders.

We do not expect that a representative of Hacker Johnson will attend the Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT

SHAREHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF HACKER

JOHNSON AS THE COMPANY’S AUDITOR.

Board Leadership Structure and Risk Oversight

Our Company’s Board does not have a current requirement that the roles of Chief Executive Officer and Chairman of the Board be either combined or separated because the Board believes it is in the best interest of our Company to make this determination based upon the position and direction of the Company and the constitution of the Board. The Board regularly evaluates whether the roles of Chief Executive Officer and Chairman of the Board should be combined or separated.

Since the Company’s formation in 2013 through to December 31, 2017, the Company had bifurcated the positions of Chairman of the Board and Chief Executive Officer. Paresh Patel had served as Chairman of the Board since April 2013 through to his resignation in December 2017. Jay Madhu has served as Chief Executive Officer of the Company since April 2013, and took on the additional role of Chairman of the Board effective January 1, 2018.

Our independent directors have determined that the most effective leadership structure for our Company at the present time is for our Chief Executive Officer to also serve as our Chairman of the Board. Our independent directors believe that because our Chief Executive Officer is ultimately responsible for our day-to-day operations and for executing our business strategy, and because our performance is an integral part of the deliberations of our Board, our Chief Executive Officer is the director best qualified to act as Chairman of the Board. Our Board retains the authority to modify this structure to best address our unique circumstances, and so advance the best interests of all stockholders, as and when appropriate.

We have three independent directors and onetwo non-independent director. We believe that the number of independent, experienced directors on our Board provides the necessary and appropriate oversight for our Company.

Management is primarily responsible for assessing and managing the Company’s exposure to risk. While risk assessment is management’s duty, the Audit Committee is responsible for discussing certain guidelines and policies with management that govern the process by which risk assessment and control is handled. The Audit Committee also reviews steps that management has taken to monitor the Company’s risk exposure. In addition, the Underwriting Committee approves and reviews our underwriting policies and guidelines, oversees our underwriting process and procedures, monitors our underwriting performance and oversees our underwriting risk management exposure. Management focuses on the risks facing the Company, while the Audit Committee and the Underwriting Committee focus on the Company’s general risk management strategies and oversee risks undertaken by the Company. We believe this division of responsibilities is the most effective approach for addressing the risks facing our Company and that our Board leadership structure supports this approach.

Board Committees and Meetings

Our Board has five committees: an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee, an Underwriting Committee and an Investment Committee. Each committee, except for the Investment Committee, has a written charter. The table below provides current membership information for each of the committees.

Nominating and | |||||

Audit | Compensation | Corporate Governance | Underwriting | Investment | |

Committee | Committee | Committee | Committee | Committee | |

| Jay Madhu | X | X | |||

| Krishna Persaud | X | X* | X* | X | |

| Ray Cabillot | X* | X | X | X | X* |

| Mayur Patel, M.D. | X | X | X | X* | |

| # of meetings held in 2019 | 4 | 1 | 2 | 4 | 4 |

| 7 |

Nominating and | |||||||||

Audit | Compensation | Corporate Governance | Underwriting | Investment | |||||

Committee | Committee | Committee | Committee | Committee | |||||

Jay Madhu | X | X | |||||||

Krishna Persaud | X | X | X | X* | |||||

Ray Cabillot | X* | X* | X |

| X | ||||

Wrendon Timothy | X | X | |||||||

Lesley Thompson | X | X | X* | X* | |||||

# of meetings held in 2021 | 4 | 2 | 2 | 4 | 5 |

__________

*

Our Board held fourfive meetings in 2019.2021. Each of our directors attended at least 80% of the meetings of the Board in 2019.

It is our policy that directors are expected to attend the Annual General Meeting of Shareholders in the absence of a scheduling conflict or other valid reason. All of our directors attended our 20192021 Annual General Meeting of Shareholders.

The Board has determined that (1) Jay Madhu doesand Wrendon Timothy do not qualify as an independent directordirectors under the applicable rules of The Nasdaq Stock Market and the Securities and Exchange Commission (“SEC”) and (2) Krishna Persaud, Ray Cabillot and Mayur PatelLesley Thompson qualify as independent directors under the applicable rules of The Nasdaq Stock Market and the SEC.

The Board has also determined that all of the current members of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee qualify as independent directors under the applicable rules of The Nasdaq Stock Market and SEC.

Below is a description of each committee of our Board.

Audit Committee

Our Audit Committee consists of three members – Ray Cabillot, Krishna Persaud and Mayur Patel.Lesley Thompson. Each of these individuals meets all independence requirements for Audit Committee members set forth in applicable SEC rules and regulations and the applicable rules of The Nasdaq Stock Market. Ray Cabillot serves as Chairman of our Audit Committee and qualifiesboth Ray Cabillot and Lesley Thompson qualify as an “audit committee financial expert” as that term is defined in the rules and regulations established by the SEC.

The Audit Committee has general responsibility for the oversight of our accounting, reporting and financial control practices. The Audit Committee is governed by a written charter approved by our Board, which outlines its primary duties and responsibilities, and which can be found on our website at www.oxbridgere.com.

| 8 |

Compensation Committee

Our Compensation Committee currently consists of three members – Krishna Persaud, Mayur Patel,Lesley Thompson and Ray Cabillot. Krishna PersaudRay Cabillot serves as Chairman of our Compensation Committee. All of the current members of our Compensation Committee qualify as independent directors under the applicable rules of The Nasdaq Stock Market.

The purpose of our Compensation Committee is to discharge the responsibilities of our Board relating to compensation of our Chief Executive Officer and to make recommendations to our Board relating to the compensation of our other executive officers. Our Compensation Committee, among other things, assists our Board in ensuring that a proper system of compensation is in place to provide performance-oriented incentives to management. Our Compensation Committee has the authority to delegate its responsibilities to a subcommittee or to officers of the Company to the extent permitted by applicable law and the compensation plans of the Company if it determines that such delegation would be in the best interest of the Company. Our Compensation Committee may engage a compensation consultant; however, it did not engage a compensation consultant with respect to executive or director compensation for 2018.

The Compensation Committee is governed by a written charter approved by our Board, which outlines its primary duties and responsibilities, and which can be found on our website at www.oxbridgere.com.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is composed of three members – Ray Cabillot, Mayur Patel,Lesley Thompson and Krishna Persaud. Krishna PersaudLesley Thompson serves as the ChairmanChair of our Nominating and Corporate Governance Committee. All of the members of our Nominating and Corporate Governance Committee qualify as independent directors under the applicable rules of The Nasdaq Stock Market.

The Nominating and Corporate Governance Committee makes recommendations to our Board as to nominations for our Board and committee members, as well as with respect to structural, governance and procedural matters. The Nominating and Corporate Governance Committee also reviews the performance of our Board and the Company’s succession planning. The Nominating and Corporate Governance Committee is governed by a written charter approved by our Board, which outlines its primary duties and responsibilities, and which can be found on our website at www.oxbridgere.com.

The Nominating and Corporate Governance Committee is responsible for reviewing the criteria for the selection of new directors to serve on the Board and reviewing and making recommendations regarding the composition and size of the Board. When our Board decides to seek a new member, whether to fill a vacancy or otherwise, the Nominating and Corporate Governance Committee will consider recommendations from other directors, management and others, including shareholders. In general, the Nominating and Corporate Governance Committee looks for directors possessing superior business judgment and integrity who have distinguished themselves in their chosen fields and who have knowledge or experience in the areas of insurance, reinsurance, financial services or other aspects of the Company’s business, operations or activities. In selecting director candidates, the Nominating and Corporate Governance Committee also considers the interplay of the candidate’s experience with the experience of the other Board members.

The Nominating and Corporate Governance Committee will consider, for director nominees, persons recommended by shareholders, who may submit recommendations to the Nominating and Corporate Governance Committee in care of the Company’s Secretary, at Suite 201, 42 Edward Street, P.O. Box 469, Grand Cayman, KY1-9006, Cayman Islands. To be considered by the Nominating and Corporate Governance Committee, such recommendations must be accompanied by a description of the qualifications of the proposed candidate and a written statement from the proposed candidate that he or she is willing to be nominated and desires to serve if elected. Nominees for director who are recommended by shareholders to the Nominating and Corporate Governance Committee will be evaluated in the same manner as any other nominee for director.

| 9 |

Underwriting Committee

The Underwriting Committee consists of three members – Mayur Patel,Lesley Thompson, Jay Madhu and Ray Cabillot. Mayur PatelWrendon Timothy. Lesley Thompson serves as Chairman of our Underwriting Committee. The Underwriting Committee’s responsibilities include approving and reviewing our underwriting policies and guidelines, overseeing our underwriting process and procedures, monitoring our underwriting performance and overseeing our underwriting risk management exposure. The Underwriting Committee is governed by a written charter approved by our Board, which outlines its primary duties and responsibilities, and which can be found on our website at www.oxbridgere.com.

Investment Committee

The Investment Committee consists of threefour members – Krishna Persaud, Wrendon Timothy, Jay Madhu and Ray Cabillot. Ray CabillotKris Persaud serves as Chairman of the Investment Committee. The Investment Committee’s responsibilities include approving and reviewing any changes to our investment guidelines, and monitoring investment performance and market, credit and interest rate exposure as a result of opportunistic investment decisions undertaken by management. The Investment Committee is governed by investment guidelines that have been approved by our Board. There is no written charter for the Investment Committee.

| Name | Age | Position | Position Since |

Jay Madhu* | 53 | Chief Executive Officer, President, and Chairman of the Board (Principal Executive Officer) | 2013 |

Wrendon Timothy | 39 | Chief Financial Officer and Secretary (Principal Financial and Accounting Officer) | 2013 |

Code of Ethics

Our Board has served asadopted a written Code of Business Conduct and Ethics that applies to our Chief Financial Officer and Secretary since August 2013. Mr. Timothy has over twelve (12) yearsprincipal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. We have posted a current copy of professional experience in business, audit and assurance service both in Trinidad and the Cayman Islands. From September 2007 through July 2013, Mr. Timothy worked as an Audit Senior and Audit Manager at PricewaterhouseCoopers Chartered Accountantscode on our website, www.oxbridgere.com, in the Cayman Islands, specializing in insurance and reinsurance clients. From September 2005 through August 2007, Mr. Timothy served as a Senior Accountant at KPMG Chartered Accountants in Trinidad and Tobago. Mr. Timothy is a Fellow“Investor Information” section of the Association of Chartered Certified Accountants and holds a Postgraduate Diploma in Business Administration and a Masterwebsite. We intend to disclose any change to or waiver from our Code of Business Administration, with Distinction (with Specialism in Finance – with Distinction), from Heriott Watt University. Mr. Timothy holds directorship with a numberConduct and Ethics by posting such change or waiver to our internet web site within the same section as described above.

Board Diversity Matrix

Each of privately-held companiesour directors possesses certain experience, qualifications, attributes and not-for-profit organizations and isskills, as further described above, that led to our conclusion that he or she should serve as a member of the Cayman Islands InstituteBoard. In addition to the foregoing biographical information with respect to each of Professional Accountants (CIIPA)our directors, the following tables evidences additional diversity, experience and an Associate Memberqualifications of the Chartered Governance Institute (formerly known as the Institute of Chartered Secretaries and Administrators)

Board Diversity Matrix (as of April 22, 2022) | ||||||

Total Number of Directors | 5 | |||||

|

Female |

Male |

Non-Binary | Did Not Disclose Gender | ||

Part I: Gender Identity | ||||||

Directors | 1 | 4 | - | - | ||

Part II: Demographic Background | ||||||

African American or Black | - | 1 | - | - | ||

Alaskan Native or Native American | - |

| - | - | ||

Asian | - | 2 | - | - | ||

Hispanic or Latinx | - |

| - | - | ||

Native Hawaiian or Pacific Islander | - | - | - | - | ||

White | 1 | 1 | - | - | ||

Two or More Races or Ethnicities | - | - | - | - | ||

LGBTQ | - | |||||

Did Not Disclose Demographic Background | - | |||||

| 10 |

DIRECTOR COMPENSATION

All directors, other than Mr. Madhu and Mr. Timothy, are entitled to receive compensation from us for their services as directors. Under the Articles, our directors may receive compensation for their services as may be determined by our Board. During 2019,

The following table sets forth information with respect to compensation earned by each of our directors (other than employee directors) during the year ended December 31, 2021.

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in |

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pension Value |

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| and |

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

|

| Nonqualified |

|

|

|

|

| |||||||||||||

|

|

|

|

|

|

|

| Non-Equity |

|

| Deferred |

|

|

|

|

| ||||||||||||

|

| Fees Earned or |

|

| Stock |

|

| Option |

|

| Incentive Plan |

|

| Compensation |

|

| All Other |

|

|

|

| |||||||

Name |

| Paid In Cash (1) |

|

| Awards (2) |

|

| Awards (3) |

|

| Compensation |

|

| Earnings |

|

| Compensation |

|

| Total |

| |||||||

| Raymond Cabillot |

| $ | - |

|

| $ | - |

|

| $ | 15,970 |

|

|

| - |

|

|

| - |

|

|

| - |

|

| $ | 15,970 |

|

| Krisha Persaud |

| $ | - |

|

| $ | - |

|

| $ | 15,970 |

|

|

| - |

|

|

| - |

|

|

| - |

|

| $ | 15,970 |

|

| Dr. Mayur Patel (4) |

| $ | - |

|

| $ | - |

|

| $ | 15,970 |

|

|

| - |

|

|

| - |

|

|

| - |

|

| $ | 15,970 |

|

| Lesley Thompson |

| $ | - |

|

| $ | 57,120 |

|

| $ | - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| $ | 57,120 |

|

(1) | During 2021, none of our non-employee directors received director fees paid in cash have been indefinitely suspended since October 1, 2017. |

(2) | All stock awards were granted under our 2014 Omnibus Incentive Plan. The value reported above in the "Stock Awards" column is the aggregate grant date fair value for the NEO's option awards granted in 2021, determined in accordance with FASB ASC Topic 718, "Compensation—Stock Compensation". The assumptions used in the calculation of these amounts are included in Note 11 of the Notes to Consolidated Financial Statements in our Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 as filed with the SEC on March 30, 2022. On November 12, 2021, Lesley Thompson was granted 16,000 restricted ordinary shares that vest quarterly in increments of 6.25%, commencing on the grant date and continuing on January 1st, April 1st, July 1st, and October 1st of each calendar year through to September 30, 2025. |

(3) | All option awards were granted under our 2014 Omnibus Incentive Plan. The value reported above in the "Option Awards" column is the aggregate grant date fair value for the NEO's option awards granted in 2021, determined in accordance with FASB ASC Topic 718, "Compensation—Stock Compensation". The assumptions used in the calculation of these amounts are included in Note 11 of the Notes to Consolidated Financial Statements in our Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 as filed with the SEC on March 30, 2022. On March 2, 2021, Raymond Cabillot, Dr. Mayur Patel and Krishna Persaud were each granted an option to purchase 50,000 ordinary shares at an exercise price of US$6.00 per ordinary share. The options vest quarterly in increments of 6.25%, commencing on the grant date and continuing on April 1st, July 1st, October 1st and January 1st of each calendar year through to December 31, 2024. |

(4) | Due to the resignation of Dr. Mayur Patel on June 30, 2021, 43,750 option awards granted to Dr. Mayur Patel were forfeited and credited back to our 2014 Omnibus Incentive Plan. |

| 11 |

The aggregate number of stock awards outstanding for each non-employee directors received cash or equity compensation award. Director fees paid in cash were indefinitely suspended since October 1, 2017.

Our Board has adopted a policy for handling shareholder communications to directors. Shareholders may send written communications to our Board or any one or more of the individual directors by mail, c/o Secretary, Oxbridge Re Holdings Limited, Suite 201, 42 Edward Street, P.O. Box 469, Grand Cayman, KY1-9006, Cayman Islands. There is no screening process, other than to confirm that the sender is a shareholder and to filter inappropriate materials and unsolicited materials of a marketing or publication nature. All shareholder communications that are received by the Secretary of the Company for the attention of a director or directors are forwarded to such director or directors.

EXECUTIVE OFFICERS

Name |

| Age |

| Position |

| Position Since |

|

|

|

|

|

|

|

Jay Madhu* |

| 55 |

| Chief Executive Officer, President and Chairman of the Board (Principal Executive Officer) |

| 2013 |

|

|

| ||||

Wrendon Timothy* |

| 41 |

| Chief Financial Officer and Secretary (Principal Financial and Accounting Officer) |

| 2013 |

* See biography above under “Director Nominees”

EXECUTIVE COMPENSATION

The following table summarizes the compensation of our Named Executive Officers, or “NEOs”, in 20192021 and 2018.

SUMMARY COMPENSATION TABLE

Nonqualified | |||||||||

Name and | Non-Equity | Deferred | |||||||

Principal | Stock | Option | Incentive Plan | Compensation | All Other | ||||

Position | Year | Salary | Bonus | Awards | Awards (1) | Compensation | Earnings | Compensation (2) | Total |

| Jay Madhu | 2019 | $232,000 | - | - | 72,838 | - | - | $5,305 | $310,143 |

| President and Chief Executive Officer | 2018 | $232,000 | $- | - | - | - | - | $7,009 | $239,009 |

| Wrendon Timothy | 2019 | $132,000 | - | - | 32,777 | - | - | $5,305 | $170,082 |

| Chief Financial Officer and Corporate Secretary | 2018 | $132,000 | $- | - | - | - | - | $7,009 | $139,009 |

Name and Principal Position |

| Year |

| Salary |

|

| Bonus |

|

| Stock Awards |

|

| Option Awards (1) |

|

| Non-Equity Incentive Plan Compensation |

|

| Nonqualified Deferred Compensation Earnings |

|

| All Other Compensation (2) |

|

| Total |

| ||||||||

| Jay Madhu |

| 2021 |

| $ | 232,000 |

|

|

| - |

|

|

| - |

|

|

| 55,895 |

|

|

| - |

|

|

| - |

|

| $ | 5,305 |

|

| $ | 293,200 |

|

| President and Chief Executive Officer |

| 2020 |

| $ | 232,000 |

|

| $ | - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| $ | 5,305 |

|

| $ | 237,305 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Wrendon Timothy |

| 2021 |

| $ | 132,000 |

|

|

| - |

|

|

| - |

|

|

| 23,955 |

|

|

| - |

|

|

| - |

|

| $ | 5,305 |

|

| $ | 161,260 |

|

| Chief Financial Officer and Corporate Secretary |

| 2020 |

| $ | 132,000 |

|

| $ | - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| $ | 5,305 |

|

| $ | 137,305 |

|

(1) | All option awards were granted under our 2014 Omnibus Incentive Plan. The value reported above in the "Option Awards" column is the aggregate grant date fair value for the NEO's option awards granted in 2021 and 2020, determined in accordance with FASB ASC Topic 718, "Compensation—Stock Compensation". The assumptions used in the calculation of these amounts are included in Note 11 of the Notes to Consolidated Financial Statements in our Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 as filed with the SEC on March 30, 2022. |

(2) | In both 2021 and 2020, Mr. Madhu received $5,305 in company contributions to our defined contribution pension plan. In both 2021 and 2020, Mr. Timothy received $5,305 in company contributions to our defined contribution pension plan. |

| 12 |

GRANTS OF PLAN BASED AWARDS IN FISCAL YEAR 2019

Our Compensation Committee, or our Board of Directors acting as our Compensation Committee granted stock options under our 2014 Omnibus Incentive Plan. Set forth in the following table is information regarding option awards granted in 2019.2021. There were no restricted stock awarded to NEOs during 2019.

Grant Date | Approval Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts Under Equity Incentive Plan Awards | All other Stock Awards: Number of Shares of Stock orUnits (#) | All other Option Awards: Numberof Securities Underlying Options (#) (1) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards ($) (2) | |

| Jay Madhu | 3/16/2019 | 3/16/2019 | - | - | - | 200,000 | $2.00 | 72,838 |

| Wrendon Timothy | 3/16/2019 | 3/16/2019 | - | - | - | 90,000 | $2.00 | 32,777 |

|

| Grant Date |

| Approval Date |

| Estimated Future Payouts Under Non-Equity Incentive Plan Awards |

|

| Estimated Future Payouts Under Equity Incentive Plan Awards |

|

| All other Stock Awards: Number of Shares of Stock or Units (#) |

|

| All other Option Awards: Number of Securities Underlying Options (#) (1) |

|

| Exercise or Base Price of Option Awards ($/Sh) |

|

| Grant Date Fair Value of Stock and Option Awards ($)(2) |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Jay Madhu |

| 3/2/2021 |

| 3/2/2021 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 175,000 |

|

| $ | 6.00 |

|

|

| 55,895 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wrendon Timothy |

| 3/2/2021 |

| 3/2/2021 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 75,000 |

|

| $ | 6.00 |

|

|

| 23,955 |

|

(1) | The amount represents a grant of stock options made pursuant to our 2014 Omnibus Incentive Plan. The options were granted conditioned on service to the company and are subject to forfeiture upon termination of employment and restriction of transfer. The options will vest in increments of 6.25% on a quarterly basis over a four calendar-year period and will expire on the 10th anniversary of the date of grant unless earlier exercised or earlier terminated due to termination of employment. |

(2) | The amounts reflect the aggregate grant date fair value for each NEO’s restricted option awards granted in 2021, determined in accordance with FASB ASC Topic 718, “Compensation—Stock Compensation”. The assumptions used in the calculation of these amounts are included in Note 11 of the Notes to Consolidated Financial Statements in our Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 as filed with the SEC on March 30, 2022. |

Employment Agreements

Jay Madhu

On July 18, 2013, we entered into an executive employment agreement with Jay Madhu, our Chief Executive Officer and President. Under the terms of this agreement, as amended, Mr. Madhu’s employment commenced on July 18, 2013 and continued for three years. Following this initial three-year term, we extended Mr. Madhu’s employment for an additional three-year term, after which the agreement will automatically renew for additional one-year terms unless either party chooses not to renew.

| 13 |

The executive employment agreement entitles Mr. Madhu to receive: (1) an annual base salary of $232,000, (2) additional compensation granted by our Board (or a committee thereof) and (3) medical, dental, life, disability, and retirement benefits.

If Mr. Madhu’s employment is terminated by us for good cause or if Mr. Madhu terminates his employment with us, he will be entitled to: (1) his accrued base salary and accrued vacation pay and other paid time off, in each case through his date of termination, and (2) reimbursement for expenses accrued through his date of termination.

If Mr. Madhu’s employment is terminated by us without good cause, he will be entitled to: (1) his accrued base salary and accrued vacation pay and other paid time off, in each case through the date of termination, (2) reimbursement for expenses accrued through his date of termination, and (3) the amount of base salary that would have been payable through the term of the agreement (excluding future automatic renewals) if his employment had not been terminated. If such termination is within three years following a change of control, Mr. Madhu will be entitled to receive, in lieu of the amount described in clause (3) directly above, an amount equal to 2.9 times the total amount of his annual base salary. If Mr. Madhu’s employment is terminated due to his death or incapacity, it will be deemed to be a termination without good cause.

Mr. Madhu’s executive employment agreement also contains non-compete and non-solicitation provisions.

Wrendon Timothy

Wrendon Timothy is our Chief Financial Officer and Secretary, and his employment with us commenced on August 1, 2013. Under the terms of this agreement,Mr. Timothy’s offer of employment, as amended, Mr. Timothy’s employment commenced on August 1, 2013 and continued for three years. Following this initial three-year term, we extended Mr. Timothy’s employment for an additional three-year term, after which the agreement will automatically renew for additional one-year term unless either party chooses not to renew. Under the agreed upon terms of employment, Mr. Timothy is entitled to receive a basic gross salary of $132,000 per year, payable monthly. His salary will be reviewed annually and may be adjusted at our discretion. We will also pay the monthly premiums for Mr. Timothy’s medical, dental, and vision insurance, and match Mr. Timothy’s contributions to his pension plan. Finally, Mr. Timothy will be eligible to receive a discretionary bonus and any other compensation which will be based on our financial performance and Mr. Timothy’s personal performance.

We may terminate Mr. Timothy’s employment without notice in the event of serious or persistent misconduct or breach of the agreed upon terms of Mr. Timothy’s employment or for cause. In other circumstances, the party that wishes to terminate Mr. Timothy’s employment must provide 60 days’ prior written notice.

| 14 |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2019

The following table sets forth information regarding outstanding stock option and restricted stock awards held by our NEOs at December 31, 2019,2021, including the number of shares underlying both exercisable and unexercisable portions of each option as well as the exercise price and expiration date of each outstanding option;

Number of Securities Underlying Unexercised Options Exercisable (#) | Number of Securities Underlying Unexercised Options Unexercisable (#) | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | ||||

| Jay Madhu | 120,000 | (1) | - | - | $ | 6.00 | 1/23/2025 | - | (3) | - | - | - |

| 25,000 | - | - | $ | 6.00 | 1/16/2026 | - | - | - | - | |||

| 18,750 | 6,250 | - | $ | 6.06 | 1/20/2027 | - | - | - | - | |||

| 50,000 | 150,000 | - | $ | 2.00 | 3/16/2029 | - | ||||||

| Wrendon Timothy | 60,000 | (2) | - | - | $ | 6.00 | 1/23/2025 | - | (4) | - | - | - |

| 10,000 | - | - | $ | 6.00 | 1/16/2026 | - | - | - | - | |||

| 7,500 | 2,500 | - | $ | 6.06 | 1/20/2027 | - | - | - | - | |||

| 22,500 | 67,500 | - | $ | 2.00 | 3/16/2029 | - | - | - | - | |||

|

| Number of Securities Underlying Unexercised Options Exercisable (#) |

|

| Number of Securities Underlying Unexercised Options Unexercisable (#) |

|

| Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

|

| Option Exercise Price ($) |

|

| Option Expiration Date |

| Number of Shares or Units of Stock That Have Not Vested (#) |

|

| Market Value of Shares or Units of Stock That Have Not Vested ($) |

|

| Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

|

| Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Jay Madhu |

|

| 120,000 | (1) |

|

| - |

|

|

| - |

|

| $ | 6.00 |

|

| 1/23/2025 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

| 25,000 |

|

|

| - |

|

|

| - |

|

| $ | 6.00 |

|

| 1/16/2026 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

| 25,000 |

|

|

| - |

|

|

| - |

|

| $ | 6.06 |

|

| 1/20/2027 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

| 150,000 |

|

|

| 50,000 |

|

|

| - |

|

| $ | 2.00 |

|

| 3/16/2029 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

| 43,750 |

|

|

| 131,250 |

|

|

| - |

|

| $ | 6.00 |

|

| 3/2/2031 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wrendon Timothy |

|

| 60,000 | (2) |

|

| - |

|

|

| - |

|

| $ | 6.00 |

|

| 1/23/2025 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

| 10,000 |

|

|

| - |

|

|

| - |

|

| $ | 6.00 |

|

| 1/16/2026 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

| 10,000 |

|

|

| - |

|

|

| - |

|

| $ | 6.06 |

|

| 1/20/2027 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

| 67,500 |

|

|

| 22,500 |

|

|

| - |

|

| $ | 2.00 |

|

| 3/16/2029 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

| 18,750 |

|

|

| 56,250 |

|

|

| - |

|

| $ | 6.00 |

|

| 3/2/2031 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

(1) | Mr. Madhu was awarded 120,000 stock options on January 23, 2015, 25,000 stock options on January 16, 2016 and 25,000 stock options on January 20, 2017, all of which have fully vested. Mr. Madhu was awarded 200,000 stock options on March 16, 2019. The options vest quarterly in increments of 12,500. The remaining 50,000 options will vest over the next 4 quarters, provided that Mr. Madhu remains employed by the Company. Mr. Madhu was awarded 175,000 stock options on March 2, 2021. The options vest quarterly in increments of 10,937.50. The remaining 131,250 options will vest over the next 12 quarters, provided that Mr. Madhu remains employed by the Company. | |

(2) | Mr. Timothy was awarded 60,000 stock options on January 23, 2015, 10,000 stock options on January 16, 2016 and 10,000 stock options on January 20, 2017, all of which have fully vested. Mr. Timothy was awarded 90,000 stock options on March 16, 2019. The options vest quarterly in increments of 5,625. The remaining 22,500 options will vest over the next 4 quarters, provided that Mr. Timothy remains employed by the Company. Mr. Timothy was awarded 75,000 stock options on March 2, 2021. The options vest quarterly in increments of 4,687.50. The remaining 56,250 options will vest over the next 12 quarters, provided that Mr. Timothy remains employed by the Company. |

OPTION EXERCISES AND STOCK VESTED IN FISCAL 2019

There were no stock awards vesting or options exercised by our NEO’s during the year ended December 31, 2019.

The primary purpose of the Audit Committee is to assist the Board in fulfilling its responsibilities relating to the general oversight of the Company’s financial reporting process. The Audit Committee conducts its oversight activities for the Company in accordance with the duties and responsibilities outlined in the Audit Committee charter.

The Company’s management is responsible for the preparation, consistency, integrity and fair presentation of the financial statements, accounting and financial reporting principles, systems of internal control and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. The Company’s independent registered public accounting firm, Hacker Johnson, is responsible for performing an independent audit of the Company’s financial statements.

The Audit Committee hereby reports as follows:

1. | The Audit Committee has reviewed and discussed the audited financial statements of the Company as of and for the year ended December 31, 2021 with management. |

2. | The Audit Committee has discussed with Hacker Johnson, the Company’s independent auditors for the year ended December 31, 2021, the matters required to be discussed by Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 16, Communications with Audit Committees. |

3. | The Audit Committee has received the written disclosures and the letter from Hacker Johnson required by applicable requirements of the PCAOB regarding Hacker Johnson’s communications with the Audit Committee concerning independence, and has discussed with Hacker Johnson its independence. |

4. | Based upon the review and discussion referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, for filing with the SEC. |

THE AUDIT COMMITTEE

Raymond Cabillot, Chairman |

Lesley Thompson Krishna Persaud |

| 16 | |

The following table sets forth the aggregate fees for services related to the years ended December 31, 20192021 and 20182020 as provided by Hacker, Johnson & Smith PA, our principal accountant:

2019 | 2018 | |

| Audit Fees (a) | $52,000 | $52,000 |

| Audit-related fees | - | - |

| Tax fees | - | - |

| All other fees | - | - |

| Total | $52,000 | $52,000 |

|

| 2021 |

|

| 2020 |

| ||

Audit Fees (a) |

| $ | 57,000 |

|

| $ | 52,000 |

|

Audit-related fees |

|

| - |

|

|

| - |

|

Tax fees |

|

| - |

|

|

| - |

|

All other fees |

|

| - |

|

|

| - |

|

Total |

| $ | 57,000 |

|

| $ | 52,000 |

|

(a) | Audit Fees represent fees billed for professional services rendered for the audit of our annual financial statements and review of our quarterly financial statements included in our quarterly reports on Form 10-Q. The above fees are exclusive of audit fees of |

Audit Committee’s Pre-Approval Policies and Procedures

Our Audit Committee charter includes our policy regarding the approval of audit and non-audit services performed by our independent auditors. The Audit Committee is responsible for retaining and evaluating the independent auditors’ qualifications, performance and independence. The Audit Committee pre-approves all auditing services, internal control-related services and permitted non-audit services (including the fees and terms thereof) to be performed for us by our independent auditors, subject to such exceptions for non-audit services as permitted by applicable laws and regulations. The Audit Committee may delegate this authority to a subcommittee consisting of one or more Audit Committee members, including the authority to grant pre-approvals of audit and permitted non-audit services, provided that decisions of such subcommittee to grant pre-approvals are presented to the full Audit Committee at its next meeting. Our Board approved all professional services provided to us by Hacker, Johnson & Smith PA and EisnerAmper Cayman Ltd. during 20192021 and 2018.

The following table sets forth information regarding the beneficial ownership of our ordinary shares as of April 9, 202022, 2022 by:

· | each person who is known by us to beneficially own more than 5% of our outstanding ordinary shares, | |

· | each of our directors and NEOs, and | |

· | all directors and executive officers as a group. |

The percentages of ordinary shares beneficially owned are based on the 5,733,5875,781,587 ordinary shares outstanding as of April 9, 2020.22, 2022. Information with respect to beneficial ownership has been furnished by each director, executive officer and beneficial owner of more than 5% of our ordinary shares. Beneficial ownership is determined in accordance with the rules of the SEC and generally requires that such person have voting or investment power with respect to the securities. In computing the number of ordinary shares beneficially owned by a person listed below and the percentage ownership of such person, ordinary shares underlying options, warrants or convertible securities held by each such person that are exercisable or convertible within 60 days of April 9, 202022, 2022 are deemed outstanding, but are not deemed outstanding for computing the percentage ownership of any other person. Except as otherwise indicated in the footnotes to this table, or as required by applicable community property laws, all persons listed have sole voting and investment power for all ordinary shares shown as beneficially owned by them. Unless otherwise indicated in the footnotes, the address for each principal shareholder is in care of Oxbridge Re Holdings Limited, at Suite 201, 42 Edward Street, P.O. Box 469, Grand Cayman, KY1-9006, Cayman Islands.

|

| Beneficially Owned at | |||||||||

|

| April 22, 2022 | |||||||||

|

|

|

|

|

|

| |||||

Name of Beneficial Owners |

| Number of Ordinary Shares |

| Percent | |||||||

5% Shareholders: |

|

|

|

|

|

| |||||

|

|

|

|

|

|

| |||||

Allan Martin |

|

| 673,628 | (1) |

| 10.61 | % | ||||

David Elliot Lazar |

|

| 456,116 | (2) |

| 7.89 | % | ||||

Mayur Patel |

|

| 367,000 | (3) |

| 6.08 | % | ||||

|

|

|

|

|

|

|

|

| |||

Named Executive Officers and Directors: |

|

|

|

|

|

|

|

| |||

Jay Madhu |

|

| 756,187 | (4) |

| 11.87 | % | ||||

Wrendon Timothy |

|

| 209,113 | (5) |

| 3.51 | % | ||||

Krishna Persaud |

|

| 511,715 | (6) |

| 8.33 | % | ||||

Lesley Thompson |

|

| 16,000 |

|

| *** |

| ||||

Ray Cabillot |

|

| 105,270 | (7) |

| 1.82 | % | ||||

All Executive Officers and Directors as a Group (5 persons) |

|

| 1,598,285 |

|

|

| 23.06 | % | |||

*** Indicates less than 1%

(1) | Consists of 175,998 ordinary shares issuable upon the exercise of warrants held by Allan Martin and his wife, Marie Martin, jointly, that are currently exercisable or exercisable within 60 days of April |

(2) | Based solely upon information contained in the Schedule 13D filed with the SEC on April 4, 2022 by David Elliot Lazar. The address of the business office of the foregoing reporting person is 1185 Avenue of the Americas, Third Floor, New York, New York 10036. |

(3) | Consists of 83,000 ordinary shares held by Mayur Patel and his wife, Ulupi M. Patel, jointly, and 249,000 ordinary shares issuable upon the exercise of warrants held by Mayur Patel and his wife, Ulupi M. Patel, jointly; 189,000 ordinary shares by Mayur Patel individually and 6,250 ordinary shares issuable upon the exercise of stock options held by Mr. Patel that are currently exercisable or exercisable within 60 days of April 22, 2022. |

(4) | Includes 125,231 ordinary shares held by Universal Finance & Investments, L.C. and 203,768 ordinary shares issuable upon the exercise of warrants held by Universal Finance & Investments, L.C. that are currently exercisable. As the sole owner and manager of Universal Finance & Investments, L.C., Mr. Madhu has voting and investment power over the ordinary shares and warrants held by that entity. Also includes 40,000 ordinary shares held in Mr. Madhu’s name and 293,498 ordinary shares issuable upon the exercise of stock options held by Mr. Madhu that are currently exercisable or exercisable within 60 days of April 22, 2022. |

(5) | Consists of 7,500 ordinary shares issuable upon the exercise of warrants held by Mr. Timothy, individually, that are currently exercisable; 25,050 ordinary shares held by Mr. Timothy, individually; and 176,563 ordinary shares issuable upon the exercise of stock options held by Mr. Timothy that are currently exercisable or exercisable within 60 days of April 22, 2022. |

(6) | Consists of 51,000 ordinary shares held by Krishna Persaud and his wife, Sumentra Persaud, jointly; 105,000 ordinary shares issuable upon the exercise of warrants held by Krishna Persaud and his wife, Sumentra Persaud, jointly, that are currently exercisable; 118,572 ordinary shares and 237,143 ordinary shares issuable upon the exercise of warrants held by held by Krishna Persaud that are currently exercisable; and 15,625 ordinary shares issuable upon the exercise of stock options held by Mr. Persaud that are currently exercisable or exercisable within 60 days of April 22, 2022. Mr. Persaud and his wife share voting and investment power over the shares and warrants held jointly in their names. |

(7) | Consists of 51,000 ordinary shares held by Ray Cabillot, individually and 3,125 ordinary shares issuable upon the exercise of stock options held by Mr. Cabillot that are currently exercisable or exercisable within 60 days of April 22, 2022; 47,045 ordinary shares and 7,225 ordinary shares held by Farnam Street Capital for the benefit of and as the General Partner of Farnam Street Partners and FS Special Opportunities I Fund, respectively. As the general partner of Farnam Street Capital, Mr. Cabillot has voting and investment power over the ordinary shares and warrants held by that entity. |

| 19 |

DELINQUENT SECTION 16(A) REPORTS

Based solely upon a review of Forms 3, 4 and 5 filed for the year ended December 31, 2021, we believe that all of our current directors, officers and 10% beneficial owners complied with all Section 16(a) filing requirements applicable to them. In addition, all such forms were timely filed, except as follows:

· | Lesley Thompson simultaneously filed a Form 3 and a Form 4 (for a transaction that occurred on November 12, 2021 reporting her initial and changes in beneficial ownership late. | |

· | Jay Madhu filed a Form 4 reporting his changes in beneficial ownership late for a transaction that occurred on March 2, 2021. | |

· | ||

· | ||

· | Krishna Persaud filed a Form 4 reporting his changes in beneficial ownership late . for a transaction that occurred on March 2, 2021. |

| Named Executive Officers and Directors: | ||

| Jay Madhu | 586,812(6) | 9.52% |

| Wrendon Timothy | 138,800(7) | 2.37% |

| Krishna Persaud | 495,715(8) | 8.16% |

| Mayur Patel | 367,000(9) | 6.13% |

| Ray Cabillot | 533,925(10) | 9.31% |

| All Executive Officers and Directors as a Group (5 persons) | 2,122,252 | 30.89% |

Reinsurance and Other Contracts with Related Parties

We had no reinsurance contracts with related parties during the yearyears ended December 31, 2019. 2021 and 2020.

During 2018, we were party to a reinsurance contract with Claddaugh, a subsidiaryeach of HCI Group. During 2018, on this reinsurance contract, we earned net premiums of $817,000.

Share Purchase Agreement between the Company and OAC Sponsor Ltd.

Mr. Madhu and Mr. Timothy are the executive officers of OAC Sponsor Ltd. (“Sponsor”) and Oxbridge Acquisition Corp. (“Oxbridge Acquisition”), and also serve on Sponsor’s and Oxbridge Acquisition board of directors.